XRP Volatility Explodes: Congress Crypto Week Impact

The cryptocurrency market is buzzing, and all eyes are currently fixed on XRP. This digital asset is exhibiting a remarkable surge in its implied volatility (IV), signaling that significant price movements are highly probable in the very near future.

As of recent trading, XRP is demonstrating strong bullish momentum, with its price trading over 5% higher at an impressive $3. This level has not been seen since early February, indicating renewed investor interest and confidence. However, the true story lies in the underlying market sentiment about its future direction.

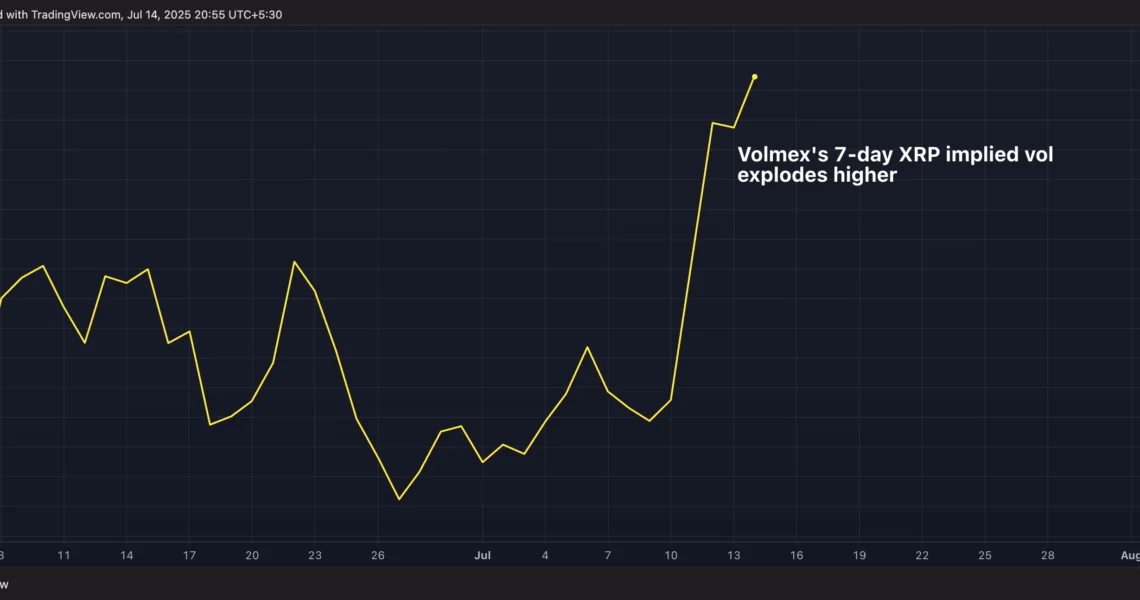

Analysis of market indicators suggests that the price of XRP is likely to swing wildly over the next week. This period coincides directly with a pivotal event: “Crypto Week on Capitol Hill” in the United States. During this crucial week, the token’s implied volatility data strongly suggests a potential rise or fall of more than 10%. This forecast is derived from sophisticated financial metrics. Volmex Finance’s seven-day XRP implied volatility index recently jumped dramatically.

It escalated to an annualized 96%, a significant increase from the previous week’s 73%. This elevated figure represents a substantial premium when compared to XRP’s seven-day historical volatility, which currently stands at a much lower 42%. The wide gap between implied and historical volatility underscores heightened market expectations for upcoming price fluctuations. This significantly elevated implied volatility directly translates into a market expectation of a 13% price swing for XRP over the coming seven days. Such a pronounced forecast highlights the immense anticipation and uncertainty surrounding XRP’s immediate future.

In stark contrast, the broader cryptocurrency market, particularly Bitcoin (BTC), is pricing in much lower volatility. The seven-day implied volatility for Bitcoin, the largest cryptocurrency by market capitalization, has increased only slightly. It currently sits at an annualized 46%, which is equivalent to an expected weekly price swing of approximately 6%. This significant divergence in implied volatility between XRP and Bitcoin underscores that the market perceives a unique and potentially transformative catalyst specifically affecting XRP in the short term.

The primary driver behind this sharp rise in XRP’s implied volatility is the impending legislative activity in the U.S. House of Representatives. This week, lawmakers are scheduled to review three major bills that possess the potential to profoundly reshape the entire digital assets industry, with direct implications for XRP.

Congress Takes Center Stage: Three Critical Crypto Bills

The current surge in XRP’s implied volatility is not merely speculative; it is directly tied to concrete legislative developments in Washington D.C. The U.S. House of Representatives has set aside this week for a focused review of three major legislative proposals that could fundamentally alter the regulatory landscape for digital assets. For the cryptocurrency industry, and particularly for XRP, these bills represent potential game-changers. Each bill addresses a distinct aspect of the nascent crypto ecosystem, aiming to bring clarity and structure to a sector that has long operated in a regulatory grey area.

The first significant piece of legislation under review is the GENIUS Act. This bill, if successfully passed into law, aims to establish a robust framework for stablecoin regulation. Specifically, it would mandate that stablecoin issuers adhere to strict financial requirements. This includes the obligation to hold liquid reserves, ensuring that the stablecoins they issue are fully backed by readily convertible assets. Furthermore, the act would require these issuers to undergo annual independent audits, providing an external layer of verification for their financial health and reserve holdings.

Lastly, the GENIUS Act would compel stablecoin issuers to publish monthly transparency reports, offering regular and detailed insights into their operations and backing assets to the public and regulators. This level of transparency and accountability is designed to instill greater confidence in stablecoins, which are often seen as a crucial bridge between traditional finance and the decentralized crypto world.

The second bill on the legislative table is the CLARITY Act. This particular piece of legislation addresses one of the most persistent and vexing issues in the U.S. digital asset space: the jurisdictional ambiguity surrounding cryptocurrencies. For years, a lack of clear demarcation between regulatory bodies has created uncertainty for crypto projects and investors. The CLARITY Act seeks to explicitly clarify whether cryptocurrencies fall under the purview of the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). The distinction is paramount; if a crypto asset is deemed a security, it falls under the SEC’s stringent disclosure and registration requirements.

If it’s classified as a commodity, it primarily falls under the CFTC’s oversight, which traditionally regulates futures and derivatives markets. This clarity is essential for establishing a predictable legal environment for crypto businesses to operate within.

Finally, the third bill under congressional consideration is the Anti-CBDC Surveillance Act. This legislation takes a firm stance against a particular type of digital currency. If enacted, this bill would prohibit the Federal Reserve from issuing a retail central bank digital currency (CBDC). A retail CBDC would be a digital form of fiat money issued directly by the central bank and available to the general public, often seen as a digital equivalent of cash.

Proponents of this bill often raise concerns about privacy, government surveillance, and the potential impact on commercial banks if the Federal Reserve were to offer direct accounts to citizens. This bill reflects a strong legislative push to limit the scope of central bank involvement in direct digital currency issuance to the public.

For XRP, which has uniquely been declared a strategic U.S. asset by the SEC (following a landmark court ruling that distinguished its programmatic sales from institutional sales), the outcome of these legislative efforts, particularly the CLARITY Act, is of immense importance. Regulatory clarity could provide a much-needed foundation for XRP to operate within a well-defined legal framework, potentially unlocking new avenues for adoption and institutional participation.

The Institutional Perspective: Unlocking Capital

The sentiment from institutional players within the crypto space underscores the profound significance of these pending legislative changes. Javier Rodriguez-Alarcón, the Chief Investment Officer at XBTO, a prominent crypto liquidity provider, emphasized the transformative potential in an emailed statement. He specifically highlighted the GENIUS Act and the CLARITY Act as being “especially important for setting institutional ground rules.”

Rodriguez-Alarcón elaborated on why these bills are so critical for the broader financial landscape. The GENIUS Act’s focus on clarifying how stablecoins should be issued and overseen directly addresses concerns about their stability and transparency, which are paramount for institutional adoption. Simultaneously, the CLARITY Act’s aim to formally define the roles of the SEC and CFTC in overseeing crypto markets tackles a fundamental barrier.

For large financial institutions, the ambiguity surrounding which regulator has jurisdiction over various crypto assets has been a significant impediment. This “legal uncertainty” has historically been “one of the core barriers to institutional participation” in the digital asset space. Institutional investors, by their nature, require a clear, predictable, and legally sound environment before deploying substantial capital into any asset class.

Rodriguez-Alarcón further articulated that establishing this “rulebook clarity” is essential because it will make “long-term capital deployment viable.” This means that without a clear set of rules and defined regulatory responsibilities, major financial entities are hesitant to commit significant, long-term investments to cryptocurrencies. With these legislative frameworks in place, the world’s largest economy, the United States, would begin to align its regulatory processes with those already underway in more progressive regions.

He pointed to examples such as the United Arab Emirates (UAE), where “defined frameworks are already unlocking tokenized markets.” The UAE has made significant strides in creating clear regulations for digital assets, which has attracted substantial investment and innovation in its crypto sector.

The potential ripple effects of these bills, if passed, are vast. Rodriguez-Alarcón noted that they “could open the door to wider stablecoin adoption.” This is crucial for facilitating more efficient and secure transactions within the crypto ecosystem and for bridging traditional finance with decentralized applications. Beyond stablecoins, clarity could also pave the way for “regulated tokenization.” Tokenization involves representing real-world assets (like real estate, art, or commodities) on a blockchain, offering greater liquidity and fractional ownership.

Finally, he stated that these bills could enable the development of “on-chain financial products with full legal backing.” This implies a future where sophisticated financial instruments, traditionally confined to conventional markets, could be built and operated on blockchain networks with clear legal certainty, attracting unprecedented levels of institutional investment and innovation into the digital asset space. This comprehensive regulatory overhaul, if successful, could truly professionalize the U.S. crypto market, making it more attractive and safer for mainstream financial players.

Understanding Implied Volatility: A Direction-Agnostic Indicator

It is crucial to understand that while implied volatility (IV) is a powerful indicator of expected price movement, it is inherently direction-agnostic. This means that the forecasted 13% swing for XRP over the next week, as indicated by its surging IV, may not necessarily be bullish and can unfold in either direction. Implied volatility simply measures the market’s expectation of how much an asset’s price will fluctuate, irrespective of whether that movement is upwards or downwards.

Think of it as a gauge of potential turbulence, not a prediction of ascent or descent. High implied volatility suggests that options traders and market participants anticipate significant price action, driven by upcoming events or news that could dramatically impact the asset’s value. It reflects uncertainty and the potential for a large shift, rather than a guaranteed gain.

Despite the direction-agnostic nature of implied volatility, XRP is currently exhibiting strong bullish momentum. This current upward trend provides context to the volatility. As mentioned, XRP has been trading over 5% higher on the day at $3, a price level it hasn’t consistently sustained since early February, according to data from CoinDesk. This recent price surge suggests that, at least in the short term, market participants are leaning towards a positive outcome from the legislative discussions. The price action indicates that a significant portion of current buying pressure is fueled by optimism that the upcoming regulatory clarity will benefit XRP.

This current bullish sentiment could be attributed to the specific nature of the bills being discussed. Given XRP’s unique legal status following its partial victory against the SEC, any legislation that provides a clearer path for digital assets to operate within existing frameworks, particularly those that distinguish between securities and commodities or regulate stablecoins, could be seen as highly favorable for XRP’s utility and adoption by financial institutions. If the legislative outcomes are perceived positively, the implied volatility could manifest as a strong upward price movement.

Conversely, if the bills fail to pass, are significantly watered down, or introduce unfavorable regulations, the same implied volatility could lead to a sharp decline. Therefore, while current market sentiment is positive, investors must remain vigilant and aware of the inherent two-sided risk associated with high implied volatility. The coming week on Capitol Hill will undoubtedly be a defining period for XRP.