Nvidia Hits $4 Trillion: AI Fuels Historic Rise

The global technology landscape witnessed an unprecedented event on Wednesday, July 9, 2025. Nvidia, the US-based chipmaker, achieved a monumental market valuation of $4 trillion, becoming the very first publicly traded company in history to reach this staggering milestone. This achievement is a clear indicator of Nvidia’s dominant position in the burgeoning artificial intelligence (AI) revolution and its profound impact on the global economy.

The company’s stock demonstrated its relentless upward trajectory, rising by 2.5% after the market opened on Wednesday. This surge propelled its market value past the $4 trillion mark, setting a new intraday record high. Nvidia’s remarkable ascent has been a defining story of the year, with its stock soaring around 20% since January 2025. This incredible growth is directly attributable to its pivotal and leading role in powering the artificial intelligence boom, which continues to reshape industries worldwide.

Surpassing Tech Giants: Nvidia’s Unrivaled Ascent

Nvidia’s journey to the $4 trillion mark is particularly significant as it has outpaced other tech titans, including Apple and Microsoft, in this race to market capitalization supremacy. Apple began 2025 as the world’s most valuable company, with a market cap hovering around $3.9 trillion. However, it experienced a significant decline in recent months, largely due to President Donald Trump’s ongoing tariff turmoil impacting global trade and supply chains.

In the preceding months, Nvidia and Microsoft had been engaged in a fierce battle for the title of the world’s most valuable company, frequently trading places at the top. This dynamic underscores the intense competition at the pinnacle of the tech industry. However, Nvidia’s recent explosive surge has allowed it to pull definitively ahead, claiming the $4 trillion threshold first and asserting its unparalleled influence in the current technological climate. This achievement solidifies Nvidia’s status as a central player in the global shift towards AI-driven innovation.

The Engine of AI: Nvidia’s Indispensable Role

Nvidia’s core business revolves around its specialized Graphics Processing Units (GPUs). These powerful chips are the computational backbone of the modern AI ecosystem. Companies like Microsoft, Amazon, and Google heavily rely on Nvidia’s GPUs to power their vast data centers, which in turn fuel their sophisticated AI models and expansive cloud services. The sheer computational demands of training and running advanced AI algorithms necessitate the kind of parallel processing capabilities that Nvidia’s GPUs uniquely provide.

Industry forecasts indicate that investments in AI infrastructure are only expected to accelerate. According to The International Data Corporation (IDC), a leading market research firm, global spending on AI infrastructure is projected to surpass $200 billion by 2028. Nvidia is positioned to capture a significant share of this expanding market, given its established technological leadership and entrenched presence in data centers worldwide.

The financial performance of Nvidia underscores its pivotal role. For the quarter that ended in April 2025, Nvidia reported a staggering $44.1 billion in revenue. This figure represents an impressive 69% increase compared to the same period a year prior, clearly demonstrating the explosive demand for its products. Wedbush Securities analyst Dan Ives, a prominent voice in tech analysis, encapsulated Nvidia’s importance in a research note on June 27, stating unequivocally: “There is one company in the world that is the foundation for the AI Revolution and that is Nvidia.” This statement highlights the consensus view among experts that Nvidia is not just participating in the AI revolution, but actively enabling it.

Evolution Beyond Gaming: AI and Robotics

Nvidia initially rose to prominence through its GPUs, which quickly became a favorite among PC gamers for their ability to render complex graphics and enhance gaming experiences. This strong foundation in graphics processing laid the groundwork for its expansion into other computationally intensive fields. Now, the company is aggressively charging ahead with the development of new AI models specifically designed to power autonomous robots and vehicles. This diversification of its AI applications demonstrates Nvidia’s vision to be at the forefront of AI innovation across multiple emerging sectors, moving beyond traditional computing to tangible, real-world applications.

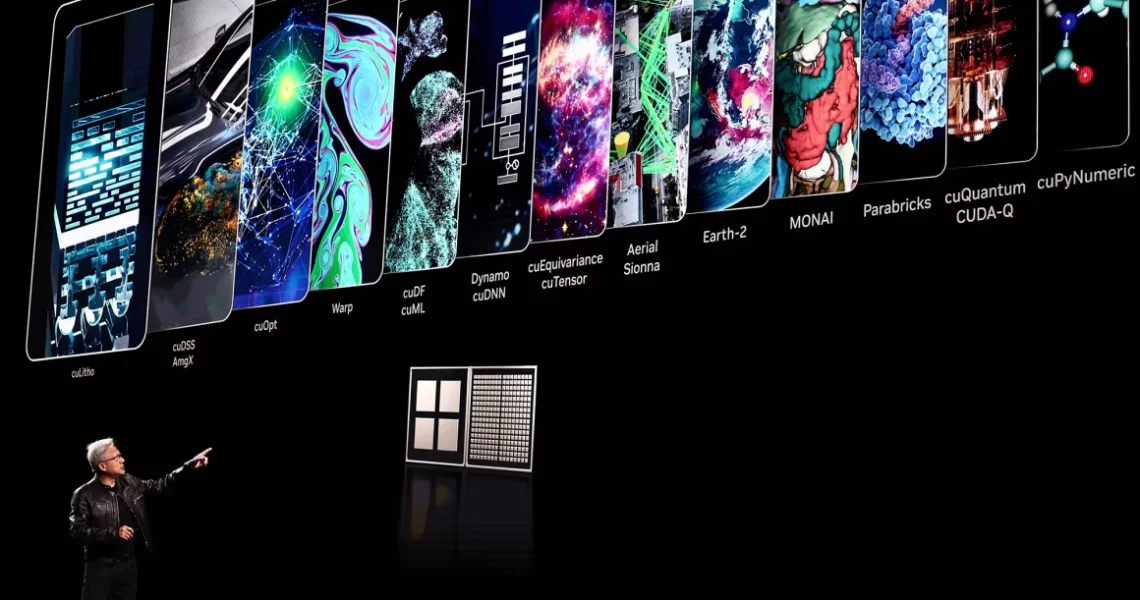

At its annual developers conference in March 2025, Nvidia made a significant announcement: an update to its highly sought-after Blackwell chip architecture. This new iteration, named Blackwell Ultra, is touted to offer even better support for AI models with more sophisticated reasoning capabilities. This continuous innovation in chip design ensures that Nvidia maintains its technological edge, providing the necessary hardware to push the boundaries of AI development.

These advanced chips are crucial for enabling AI to handle more complex tasks, understand nuances, and perform more human-like reasoning, further expanding the potential applications of artificial intelligence across various industries.

Jensen Huang’s Rising Influence and Political Connections

Nvidia’s astronomical success in the AI gold rush has profoundly impacted its CEO, Jensen Huang. Huang has rapidly ascended the ranks of the world’s wealthiest individuals. As of Tuesday, July 8, 2025, the Bloomberg Billionaire’s Index pegged him as the tenth wealthiest person globally, with an estimated net worth of $140 billion. His immense personal wealth is a direct reflection of Nvidia’s market dominance and its indispensable role in the AI industry.

Beyond the tech industry, Huang has also found himself increasingly within the orbit of political power, specifically with President Donald Trump. This elevated profile extends his influence beyond technology into the realm of national and international policy. Huang has met directly with the President on multiple occasions. He was notably among several high-profile tech executives who accompanied President Trump during a significant trip to Saudi Arabia in May 2025. This visit underscored the strategic importance of technology and AI on the global stage.

Furthermore, Nvidia is a key partner in Project Stargate, an ambitious $500 billion AI infrastructure initiative that President Trump announced in January 2025. This massive project is being touted as central to the President’s push to significantly grow America’s tech footprint and ensure its leadership in artificial intelligence. Nvidia’s involvement in such a high-profile, government-backed initiative solidifies its position not just as a corporate leader, but as a strategic national asset in the global AI race.

Navigating Challenges: The Road to $4 Trillion

Nvidia’s rapid ascent to a $4 trillion market cap has not been without its challenges. The journey has involved navigating intense competition, geopolitical tensions, and market fluctuations.

The DeepSeek Scare

Earlier in 2025, a significant event shook Wall Street and Silicon Valley: the emergence of DeepSeek, a Chinese startup that unveiled a powerful, yet supposedly low-cost, AI model. This development sparked immediate questions within the industry about whether the previously assumed necessity for incredibly costly chips and specialized hardware, largely dominated by Nvidia, was truly essential to advance AI.

The implication was that perhaps AI development could become more democratized and less hardware-dependent. This uncertainty directly impacted Nvidia, sending its stock plunging in January 2025. Investors temporarily questioned the long-term sustainability of Nvidia’s high-cost, high-margin chip business model if cheaper alternatives could achieve similar AI capabilities.

US-China Trade Tensions

Nvidia has also found itself caught in the crosshairs of the escalating AI race and trade tensions between Washington and Beijing. Export restrictions imposed by the U.S. government on advanced AI chips to China have directly impacted Nvidia’s revenue. The company explicitly stated that it missed out on an estimated $2.5 billion in additional revenue for the fiscal quarter that ended in April 2025, specifically because of these export restrictions on its H20 AI chips to China. This geopolitical friction presents an ongoing challenge for Nvidia, as China represents a vast and critical market for high-end AI hardware.

These combined pressures, including the DeepSeek fears and the tightening US-China trade tensions, caused Nvidia’s shares to tumble as much as 37% from January to April 2025. However, demonstrating remarkable resilience and investor confidence, Nvidia has since rallied significantly. The stock has gained almost 74% since early April 2025, not only recovering its losses but surging to new record highs, culminating in its historic $4 trillion valuation. This comeback underscores the market’s fundamental belief in Nvidia’s long-term dominance and the indispensable nature of its technology for the AI revolution.

Future Outlook: Continued Growth and Market Dominance

Despite the challenges, Nvidia’s leadership remains highly optimistic about the company’s future growth prospects. On Nvidia’s earnings call in May 2025, CEO Jensen Huang articulated a broad and ambitious vision for AI’s pervasive impact. He emphasized that AI will become an essential component for “every country” and “every industry.”

Huang elaborated on this transformative potential, stating, “Of course, we know that AI is this incredible technology that’s going to transform every industry, from, of course, the way we do software to health care and financial services to retail to, I guess, every industry, transportation, manufacturing.” He concluded with a powerful statement underscoring the early stage of this revolution: “And we’re at the beginning of that.” This vision suggests a long runway for growth, as AI adoption deepens across diverse sectors globally.

Wall Street analysts largely echo Huang’s bullish outlook, with many expecting Nvidia’s market capitalization to continue its upward trajectory. In a June 2025 research note, analysts from investment firm Loop Capital provided an even bolder forecast, estimating that Nvidia could potentially reach a staggering $6 trillion market cap by 2028.

Loop Capital analysts Ananda Baruah and Alek Valero reinforced their confidence in the company, writing, “While it may seem fantastic that (Nvidia) fundamentals can continue to amplify from current levels, we remind folks that (Nvidia) remains essentially a monopoly for critical tech” in the AI sector. This highlights the belief that Nvidia’s technological advantage in highly specialized AI hardware provides it with a near-monopoly position in a rapidly expanding and critical market, paving the way for continued, unprecedented growth.