CoreWeave Stock Falls Amid High Spending Plans

CoreWeave, the specialized cloud provider backed by Nvidia and focused on AI infrastructure, saw its stock price decline by over 5% on Thursday.

CoreWeave Stock Falls Amid High Spending Plans

This market reaction followed the company’s first earnings report since becoming a public entity, where key financial disclosures, particularly concerning future spending and existing debt, appeared to temper investor enthusiasm generated by strong revenue projections and a new significant deal with OpenAI.

Soaring Capital Expenditures Raise Investor Concerns

A primary driver of the stock’s downturn was CoreWeave’s projection for capital expenditures (capex) in 2025. The company announced it expects to spend between $20 billion and $23 billion next year. This forecast significantly exceeded Wall Street analysts’ consensus estimates, which had predicted a lower figure of approximately $18.3 billion, according to Bloomberg data.

High capital expenditure signals aggressive investment in infrastructure, which is necessary for growth in the data center and AI computing space. However, it also implies substantial cash outflow and the need for significant funding, which can raise concerns among equity investors about profitability timelines and financial leverage.

CoreWeave’s CFO, Nitin Agrawal, stated that the planned increase in spending is “fundamentally driven by increased customer demand,” indicating the company sees a direct link between investment and anticipated revenue from its services.

The Weight of Debt and Rising Interest Costs

Adding to investor caution are CoreWeave’s substantial debt levels and the rising cost of servicing that debt. The company currently carries roughly $12 billion in debt commitments. A notable aspect of CoreWeave’s financial strategy is its use of this debt, often borrowed at what analysts describe as very high interest rates, to acquire more Nvidia graphics processing units (GPUs), using its existing GPU inventory as collateral.

DA Davidson analyst Gil Luria highlighted the risk inherent in this model, telling Yahoo Finance that the company is “borrowing at extraordinarily high interest rates in order to buy a product that depreciates very rapidly in terms of its economic value.” This perspective points to a potential challenge in maintaining the value of the collateral relative to the cost of borrowing.

The impact of this debt was evident in CoreWeave’s first quarter results. Interest expenses soared by 549% year-over-year to $264 million, significantly surpassing Wall Street’s projection of $182 million for the quarter, according to Bloomberg data. The dramatic increase in interest costs impacts the company’s bottom line and financial flexibility.

Strong Revenue Outlook and OpenAI Partnership

Despite the concerns over spending and debt, CoreWeave’s earnings report also contained positive news, particularly regarding its revenue outlook and key customer relationships.

The company provided a robust revenue forecast for the second quarter, projecting between $1.06 billion and $1.1 billion, and a full-year 2024 outlook of $4.9 billion to $5.1 billion. These figures exceeded analyst expectations of $1.04 billion for Q2 and $4.6 billion for the full year, based on Bloomberg data.

Fueling this optimistic outlook is continued strong demand from major AI players. CoreWeave disclosed a new, significant $4 billion contract with OpenAI, secured in May. This adds to a previously reported commitment of $11.9 billion from the AI research firm, bringing the total value of their deals to an impressive $15.9 billion.

CoreWeave stated that these substantial contracts with OpenAI are key contributors to its high revenue projections for the upcoming periods. The announcement of the OpenAI deal had initially led to a positive reaction in pre-market and after-hours trading, with the stock climbing before reversing course on Thursday.

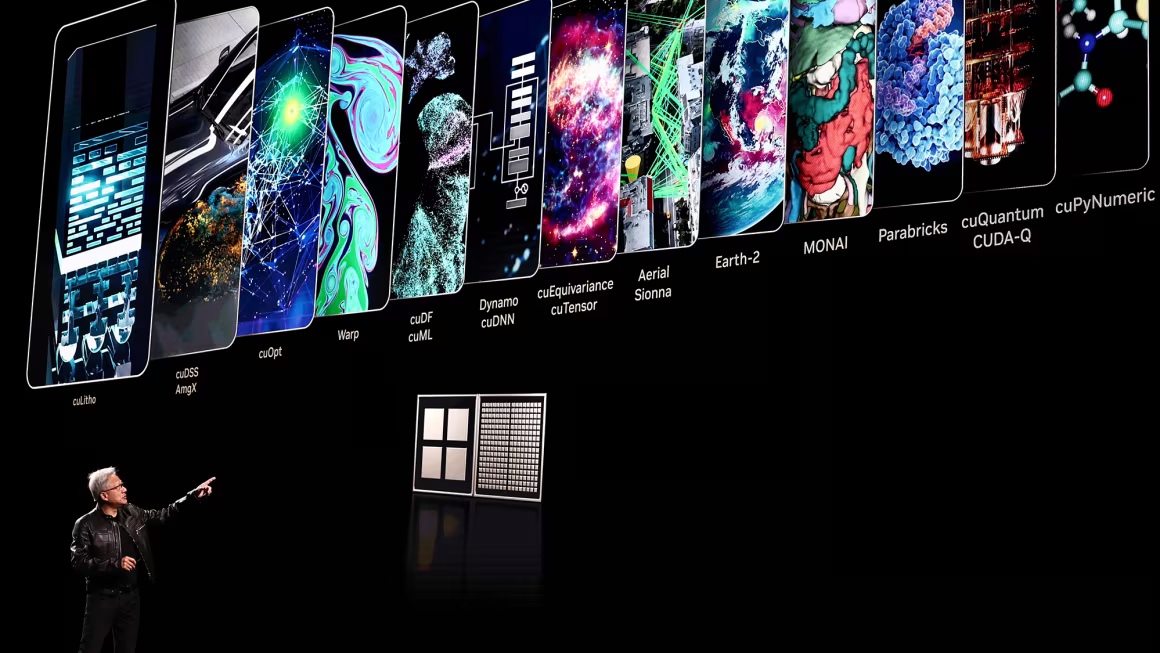

Business Model: Powering AI with Nvidia GPUs

CoreWeave’s business model is centered on providing specialized cloud infrastructure tailored for intensive AI and machine learning workloads. This requires a massive inventory of high-performance GPUs, predominantly from Nvidia, which are in high demand.

CoreWeave rents out its data center capacity and computing power to major technology companies like Microsoft and Meta, who require this specialized hardware to train and run their complex AI models and services. The company’s Q1 financial filing revealed that a significant 72% of its $981.6 million in revenue came from Microsoft, with DA Davidson analyst Gil Luria noting that much of Microsoft’s spending with CoreWeave is directed towards powering services for OpenAI.

First Quarter Financial Performance Overview

Looking at the first quarter results specifically, CoreWeave reported revenue of $981.6 million. However, the company also posted an adjusted net loss of approximately $150 million for the quarter. This loss was steeper than the $41.7 million loss that Wall Street analysts had anticipated, according to Bloomberg data, indicating that while revenue growth is strong, the company is still in a phase of significant investment leading to unprofitability on an adjusted basis.

Analyst Perspectives and Market Reception

The mixed financial picture has resulted in a range of opinions among Wall Street analysts covering CoreWeave. According to Bloomberg, seven analysts currently hold Buy ratings on the stock, largely based on the booming demand for AI infrastructure and CoreWeave’s position in the market. However, eight analysts maintain a Neutral rating, reflecting a more cautious stance that likely incorporates the financial risks highlighted by the recent disclosures.

Stifel analyst Ruben Roy, who has a Buy rating, remains positive on the company’s long-term prospects, citing CoreWeave’s “first to market positioning as a purpose built AI infrastructure provider.”

Conversely, Macquarie analyst Paul Golding, holding a Neutral rating, noted ahead of the earnings report that while the outlook for the AI space offers “scope for further growth,” the company’s “competitiveness” is also a factor to consider. The recent stock performance underscores the market’s current focus on the financial intensity of CoreWeave’s growth strategy.

IPO Context and Stock Volatility

CoreWeave became a public company relatively recently, completing its IPO in March. The company raised $1.5 billion in its market debut, a figure lower than the $4 billion it had initially aimed to raise. Since its IPO, CoreWeave’s stock has experienced volatility, with investors weighing the company’s significant financial leverage and losses against the highly bullish outlook for the AI market and the strong demand for its services.

Prior to Wednesday’s earnings release, the stock had shown a significant gain of 66% since its market debut, illustrating the strong underlying investor optimism before the latest financial details were fully digested.

The Path Forward: Balancing Growth and Financial Health

CoreWeave’s situation highlights the challenging balancing act for companies operating at the bleeding edge of the AI infrastructure boom. The immense demand necessitates massive capital investment and leveraging debt to acquire essential hardware like Nvidia GPUs.

While this fuels rapid revenue growth and secures major contracts with industry leaders like OpenAI and Microsoft, it also leads to significant expenditures and interest costs that impact profitability. The company’s future stock performance will likely depend on its ability to effectively manage its aggressive spending, service its substantial debt load, and demonstrate a clear path towards sustainable profitability while continuing to capitalize on the insatiable demand for AI computing power.