Cava Exceeds Revenue Estimates, Defies Industry Slump

Mediterranean fast-casual restaurant chain Cava has announced impressive financial results for its latest fiscal quarter, concluding on April 20th.

Cava Exceeds Revenue Estimates, Defies Industry Slump

On Thursday, the company reported revenue figures that surpassed analysts’ expectations, a noteworthy achievement given the prevailing challenges in the broader restaurant industry where many consumers have significantly curtailed their dining out expenses. Cava’s robust performance highlights its unique market position and growing appeal.

Defying Industry Headwinds: A Strategic Advantage

While much of the restaurant sector has been grappling with a noticeable slowdown in consumer spending—a “malaise,” as some describe it—Cava has managed to buck the trend.

The company’s success is particularly striking when contrasted with the struggles faced by numerous competitors, suggesting a strategic advantage in a tightening economic environment. Cava’s fresh, customizable bowls and pitas appear to resonate strongly with consumers seeking both value and quality, positioning it favorably in the competitive fast-casual segment.

Key Performance Indicators: Same-Store Sales & Traffic

A critical measure of a restaurant chain’s health, Cava’s same-store sales, which track the sales performance of locations open for at least a year, surged by a significant 10.8% during the three-month period. This figure comfortably exceeded the 10.3% growth projected by analysts surveyed by StreetAccount. Driving this impressive growth was a substantial 7.5% increase in customer traffic, underscoring that more diners are choosing Cava and contributing to its consistent sales momentum.

Understanding Cava’s Customer Behavior Trends

Tricia Tolivar, Cava’s Chief Financial Officer, shed light on the consumer behaviors underpinning this strong performance. Speaking to CNBC, Tolivar noted an uptick in “premium attachment,” where customers opted for higher-priced add-ons such as Cava’s signature pita chips or house-made juices.

The company also observed a continued increase in its “per person average” spending. Furthermore, Cava experienced positive traffic growth across all its operational segments, including diverse geographic regions, varying income demographics, different restaurant formats (from traditional dine-in to digital-focused), and all dayparts (breakfast, lunch, dinner), indicating broad-based appeal.

Tolivar further elaborated on a trend the company has consistently observed over several quarters: diners are strategically “trading up” from traditional fast-food establishments while simultaneously “trading down” from more expensive casual-dining restaurants into Cava’s accessible yet high-quality offerings. This positions Cava as an attractive middle ground for budget-conscious consumers seeking healthier, flavorful options.

A Contrasting Picture: Challenges Across the Restaurant Sector

Cava’s stellar performance stands in stark contrast to the struggles reported by many other major players in the restaurant industry. For instance, rival fast-casual chain Chipotle experienced a 2.3% drop in transactions during its first quarter, attributed to consumers pulling back spending amid economic uncertainty, particularly in February.

Sweetgreen, another fast-casual competitor, reported its first quarterly same-store sales decline since its public listing in 2021. Even global giants like McDonald’s have felt the pinch, with CEO Chris Kempczinski noting that industry data showed both low- and middle-income consumers spending less. McDonald’s itself reported a 3.6% decline in U.S. same-store sales for its first quarter, underscoring the widespread impact of economic pressures.

Financial Highlights: Earnings, Revenue, and Milestones

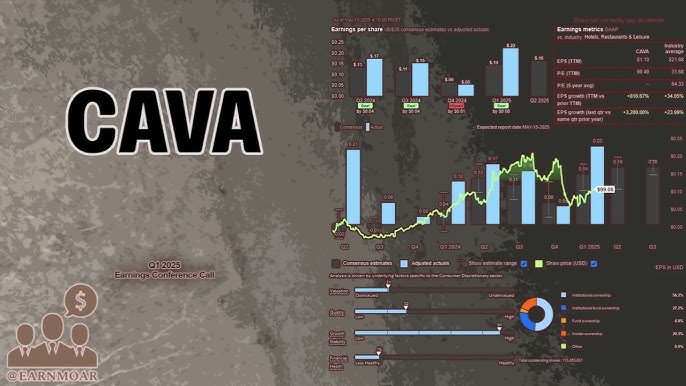

From a broader financial perspective, Cava delivered robust figures that significantly outpaced Wall Street’s expectations. The company reported earnings per share of 22 cents, far exceeding the 14 cents per share analysts anticipated, according to a survey by LSEG. Total revenue for the quarter reached $332 million, surpassing the expected $327 million.

Net income for the fiscal first quarter stood at $25.71 million, or 22 cents per share, marking a substantial increase from $13.99 million, or 12 cents per share, reported in the same period last year. It’s worth noting that Cava’s earnings were boosted by a $10.7 million income tax benefit related to stock-based compensation. Overall net sales climbed an impressive 28% to reach $332 million. A significant milestone for the company, Cava’s revenue on a trailing 12-month basis has now officially surpassed $1 billion, signaling its growing market footprint.

Strategic Outlook: Reaffirming & Raising Projections

Despite the exceptionally strong quarterly performance, Cava maintained a largely conservative stance on its full fiscal year outlook for same-store sales growth, reiterating its previous projection of a 6% to 8% increase. The company had previously indicated expectations for slower growth in the latter half of its fiscal year 2025.

However, Cava did incrementally raise some of its other key projections for the fiscal year. The company now anticipates adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to be between $152 million and $159 million, an uptick from its prior forecast of $150 million to $157 million. Additionally, Cava plans to accelerate its expansion efforts, targeting between 64 and 68 new restaurant openings, an increase from its previous outlook of 62 to 66 new locations.

Investor Reaction and Market Perceptions

Despite the positive financial results, Cava’s stock experienced a 5% decline in extended trading following the announcement. This reaction reflects broader investor concerns that have seen Cava shares slide 11% year-to-date as of Thursday’s close.

Market anxieties primarily stem from the company’s conservative outlook for the latter half of the fiscal year and the lingering macroeconomic impact of geopolitical factors. While Cava’s operational performance remains strong, investor sentiment appears to be tempered by broader economic uncertainties and a cautious forward guidance.

The Future of Fast-Casual: Cava’s Path Forward

Cava’s latest earnings report paints a picture of a company skillfully navigating a challenging economic landscape. By appealing to consumers’ desire for fresh, customizable, and value-driven meals, it has carved out a robust niche in the fast-casual segment.

The strategic move by consumers to trade up from lower-cost options and down from more expensive dining experiences bodes well for Cava’s continued growth trajectory. With aggressive expansion plans and a proven ability to attract and retain customers, Cava is poised to further solidify its position as a leading Mediterranean fast-casual chain in the U.S., setting a compelling example for the evolving restaurant industry.